Covid continues to dominate the news headlines, however, global stock markets, led by the US and the NASDAQ index, have continued to climb higher over the summer months. Economies around the world have reopened from lockdowns and activity has picked up strongly over the summer months. Government bond markets have largely traded sideways as central bank buying continues to support record low yields. Credit markets too have benefited from central bank action and yields have continued to compress. Despite the viciousness of the recession, defaults seem set to be significantly lower than feared in March.

US second quarter earnings held up incredibly well, spurring analysts to revise higher their forecasts. Covid has devastated the pleasure and leisure sectors, and while this might suck the fun out of life, these sectors do not constitute a large segment of the stock market. Q2 S&P 500 earnings were far better than expected, both by number and magnitude of an upside surprise, and are on course to decline by around a third. Some 84% of companies have reported earnings ahead of estimates, and the average upside surprise over the quarter was 23.1%. This is the largest in over a decade according to Factset.

The tech sector, and related online businesses, have been driving stock markets higher. Apple’s market cap went through $2tn during the quarter, a valuation that exceeds the entire FTSE 100. Over the last 4 calendar years, Apple’s profits are up 11% and yet the shares have quadrupled. By early September, Tesla became the 9th largest listed company in the world, despite only starting to sell cars 12 years ago. Earnings have finally turned positive this year yet it makes only a thin slither of profits. The average p/e of the 5 US largest stocks recently hit 44x, this compares to 50x at the height of the tech bubble in 1999. In those days, Amazon was just a book shop, today these businesses are on far stronger footings and they are clear beneficiaries of Covid. A further factor in their favor is that low interest rates allow profits to be modestly discounted way into the future. Nevertheless, investors need to be very certain that the profits will arrive to justify such ratings. Colossal businesses, trading on high multiples will require vast profits. This hasn’t stopped an army of US retail investors piling in, some through the options market. This does not feel healthy.

There is plenty that can derail the prospects for these stocks. Joe Biden is polling well ahead and seems well entrenched from an electoral college standpoint. Trump could cause an upset (the bookies think he might) but to do so, he would have to win virtually every marginal State. The fiscal deficit was appalling even ahead of the pandemic, and Biden is threatening to lift corporation taxes to fund his healthcare and environmental promises. Furthermore, he may be a lot more sympathetic to any anti-trust attacks against the big firms, it was very evident listening to the Congressional hearings over the summer that on-line monopolies are being carved out.

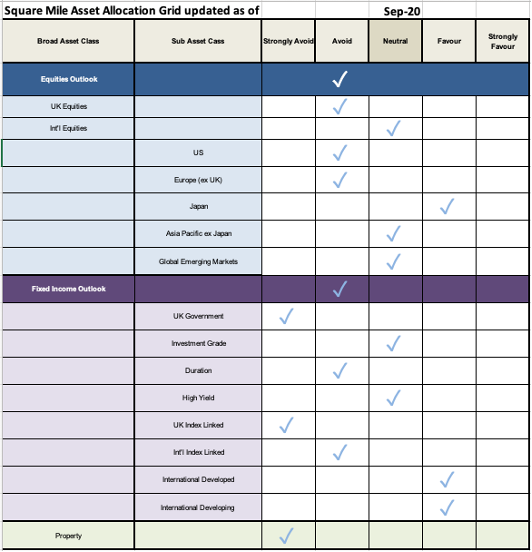

We have been astonished by Trump’s treatment of his largest trading partners but this is nothing compared to the mishandling of the Tory grandees relationship with the EU. It is staggering to comprehend the folly of the political posturing going on and the threats to the commerce that benefits us all. The UK market has continued to languish over the summer, the FTSE 100 has now underperformed the S&P 500 by 90% over the last 5 years. Not all of this is Brexit related of course, the index had a larger exposure to Covid related companies than many others for instance. One of the positive impacts of this underperformance has been a gradual rebalancing of the index away from energy companies and banks. The high component of non-UK earnings in the FTSE 100 is an attractive feature at a time when the UK is barrelling towards a trade precipice. Making valuation comparisons between markets is tricky at times when profits are so uncertain, but the UK market is on 18 times price-to-earnings which compares to 27 times on the US. UK dividends have collapsed this year and this has removed a long term support for the market. Interestingly, our rated UK managers are suggesting that dividend payments could be fully restored by 2024. This would place the market on a generous forward yield and a rerating could be in order. We will soften our avoidance stance on the market as a result.

Our thoughts expressed in this blog relate only to the portfolios we manage, or advise on, on behalf of our clients and as such may not be relevant to portfolios managed by other parties. This is not a recommendation to buy or sell any individual stocks that are mentioned.